Starting a new business can feel exhilarating. Finally, finally, you’re pursuing your dream of opening the coziest café in your town. Or maybe you’re launching a B2B company that sells high-quality microfiber cloths and cleaning products to professional cleaners. Or perhaps you’re a website designer for authors and your business will be 100% online, enabling you to work from home for the first time.

Whatever your passion is, starting a business can make you feel over-the-moon excited. But it’s also daunting. There are countless things to do as you prepare for launch day.

No matter what type of business you’re building, a business startup checklist can help you get organized and set you up for success.

In this article, I’ve compiled the most important tasks to complete before you open up shop—and how to get them done. Here are 12 tips to consider for your business startup checklist.

1. Conduct Market Research

With the market as saturated as it is, market research is key to making sure there’s an audience out there who wants to buy your product. Market research helps answer important questions, such as:

- Is there an audience for my product?

- Where are these customers located? Online? Locally?

- What segments, if any, can my audience be divided into?

- Who are my top competitors?

- What makes my business stand out?

There are lots of tools that can help you do market research. Some are free, like social media. Say your business will be designing websites for authors and other creatives. Try searching #authorwebsite on Instagram and see what comes up.

In addition, Facebook and LinkedIn let you run polls to help find out if your friends and contacts like your idea—or not. Sites like Pew Research Center, the United States Census Business Data, AnswerThePublic, Social Mention, and Pollfish can deepen your knowledge of your target audience.

Market research is necessary before you start a business, but it’s also crucial to do every time you launch a new product, develop marketing strategies, make changes to your website, and so much more. For tools, tips, and tricks, see QuickSprout’s guide to market research.

2. Pick a Business Name and Structure

Starting a business involves a lot of legal paperwork, but you can’t do that paperwork without first choosing a business name and structure. A business name should be:

- Compliant with state guidelines

- Distinct from competitors’ business names

- Easy to say and spell

- Memorable

- Web-friendly

Our guide to choosing the best business name can help you get started. Once you’ve picked a name, it’s time to figure out which business structure fits you best. There are several different structure types, each with its own set of legal requirements.

- Sole proprietorship: If you’re the only person in your business, you’re automatically a sole proprietor when you begin to conduct business activities. This won’t change unless you register to become a different type of business. As a sole proprietor, you and your business are one entity, meaning you are personally liable for it. Freelancers, small local businesses, and IT consultants are often sole proprietorships.

- Partnership: Are you and a friend starting a business together? You can either start a limited partnership (LP) or a limited liability partnership (LLP). In an LP, the primary partner holds unlimited liability, while all other partners hold limited liability—and usually less control over the company. An LLP gives each member of the partnership equally limited liability. Attorneys, doctors, and accountants often form LLP firms.

- Limited liability company (LLC): In an LLC, you and your business are separate entities—mostly. If your business owes a debt, you aren’t personally liable, but your business’s accounts are. Despite this, you can pass profits and losses through to your personal income and avoid paying corporate tax, but you’ll still need to pay self-employment taxes. Several huge companies, like Johnson & Johnson and Exxon Mobil, are LLCs, although many small businesses go this route, too.

- Corporation: This common business structure separates businesses from the people who own them—the shareholders—holding only the business liable for any debts or lawsuits. Corporations must pay income tax on profits, however, and they are complicated to set up and maintain. The types of corporations are an alphabet soup of C corps, S corps, B corps, close corporations, and nonprofit corporations. You can learn more about these different corporation types in our beginner’s guide to business structure.

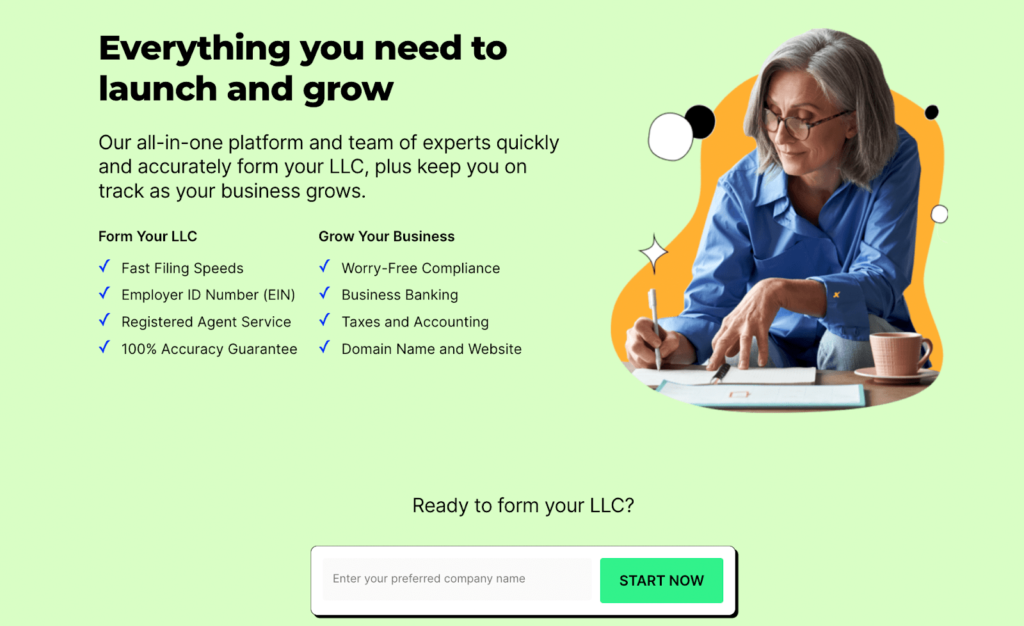

Each of these business structures comes with different requirements for filing taxes and becoming legally established as a business. Tools like ZenBusiness can help you manage the often-overwhelming paperwork you’ll need to do.

3. Register Your Business

Officially registering your business can feel like a big deal, and it is definitely a milestone to celebrate. Sometimes, the process is straightforward. But in other cases, it’s a little more complex. It all depends on where you’re doing business and what type of products or services you’ll be offering.

If you’re a sole proprietor doing business under your legal name, you won’t need to register at all. All corporations, limited liability companies, and partnerships will most likely need to register at the state level, although requirements vary by state. Registration also depends on where you’re setting up shop—will you be 100% online, or will you have a brick-and-mortar location?

Make sure you do the research to find out what your state requires. This information is often found on state government websites. Conduct a Google search to register a business in [your state] and click on the government website that pops up.

![An example of a state government’s homepage for business licensing forms and fees.]](https://www.quicksprout.com/wp-content/uploads/2022/08/checklist3-min-1024x833.png)

You’ll typically need a business name and location, along with information pertaining to the ownership and business structure, when you register with your state.

Aside from obtaining a federal tax identification number, most businesses don’t need to register at the federal level. The exception is any business that engages in:

- Selling alcohol, tobacco, or firearms

- Broadcasting

- Preparing meat products

- Manufacturing drugs or medications

- Ground or air transportation services

See the government’s requirements for staying compliant for more information.

In addition, certain types of businesses may need to obtain city, county, and state licenses to legally do business. Think medical offices, restaurants, cosmetologists, appraisers, banks, building contractors, and counselors.

Throughout this process, keep a copy of every document you submit and file it in a safe place for your official business records.

4. Get Federal and State Tax Identification Numbers

Most sole proprietors can use a social security number to file taxes, but if they’d rather not use their SSN, they can apply for federal and state tax ID numbers. Every other type of business must get these tax ID numbers.

A federal tax ID is called an employer identification number (EIN). Some sites on the web will sell you an EIN—don’t fall for it. Applying for and receiving an EIN is free and can be done on the IRS website.

Not every business needs a state tax ID. The best way to find out if you need one—and how to apply for one—is to look at the requirements on your state’s government website.

5. Open a Business Bank Account

If you’re an LLC, corporation, partner, or any type of business that isn’t a sole proprietorship, you’ll need to open a business bank account under your business name.

Before you head to the bank—whether an online or brick-and-mortar branch—gather the following documents:

- Employer identification number (EIN)—or social security number if you’re a sole proprietor

- Business license and any paperwork filed to obtain that license

- Certificate of your legal business name and/or Doing Business As (DBA) name

Next, research banks that have reasonable fees, perks, and straightforward applications for new businesses. Chase Business Complete CheckingSM, for example, currently offers a $300 signup bonus for new members and makes it easy for you to apply online or in a physical Chase branch.

6. Create a Business Plan

A business consists of dozens—if not hundreds—of moving parts. Things are always changing, growing, slowing down, and taking off, often all at once. Putting together a business plan can help you organize your business and create goals to hit in the days, months, and years after launch day.

Plus, if you need to secure funding from investors to even get your business off the ground, you’ll need to have a strong business plan to back you up.

There are countless templates to use and methods to follow when it comes to drafting a business plan, but each one can be linked to one of two popular styles: traditional and lean business plans.

A traditional plan focuses on detailed, often lengthy explanations for how certain aspects of the business will be run. Most traditional plans include the following elements:

- Executive summary: An intro that includes a mission statement, product or service, leadership roles, employee roles, location, financial information, and growth plans

- Company description: Detailed information about how the company, service, or product fulfills various customer needs

- Market analysis: Includes the results of the market research you’ve done to narrow down your target audience, who your competitors are, and how you’ll improve on what they already do

- Services or products: Outline what products or services you’ll offer, along with any development information for products you’re creating on your own

- Marketing and sales: An explanation of how you’ll reach customers, what a sale or transaction will look like, and how you’ll keep customers coming back

- Management and organization: Introduce the company’s management and business structure, and outline each leader’s qualifications and how they relate to the company

- Funding request: If you’ll need funding to start your business, this is where you ask for it, outlining whether you’d like equity or debt, detailing what you need the money for, and estimating how profitable you plan to be within the next five years

- Financial projections: A place to tell the financial narrative of your business and prove that it can be financially successful

- Appendix: Include all relevant documentation to support your business plan

In sharp contrast to this detailed type of business plan, a lean plan is usually a one-page document that quickly outlines the topics on this non-exhaustive list:

- Business identity: who you are and what you do

- Customers: what your target audience looks like

- Problem: explain what problem you solve for your customers

- Competitors: define the competition and what you do differently

- Key resources: identify any business partners or relationships you’ll need

- Revenue streams: explain how your business will earn money

- Marketing: how you’ll reach and retain customers

- Sales Channels: what a sale will look like

- Team: which roles you’ll need leaders and employees to play

Regardless of which format you choose, tools like LivePlan can help you write a business plan that can easily adapt to the inevitable changes you’ll face.

7. Secure Funding

Every business has startup costs. Until your company becomes profitable and you can stand on your own two feet, you’ll need funding to support your work.

There are many ways to find funding for a business, but before you begin, do the math to figure out exactly how much you’ll need to get up and running.

Next, see if you can dip into a savings account and fund it yourself without risking your personal financial security. If you can’t, look into other options, like crowdfunding, small business loans, angel investors, or venture capital firms. Make sure you have a foolproof business plan written before you try to get someone to sign on to support your business.

8. Choose a Location

If you don’t plan to run your business entirely from the comfort of your own home, you’ll need to rent or lease an office. Find a realtor who specializes in commercial leases to help guide you through this often-confusing process.

When you find a potential location, you’ll need to:

- Research the area: If you simply need office space or a place to develop your products, location isn’t as important as it would be for a bookstore. Conduct research accordingly. For a bookstore, you might need to find out if the bookstore is in a central area. Can people walk to it from a favorite café or restaurant? Is it prominent and easy to find?

- Get to know the landlord or building owner: Sometimes, the landlord and building owner are not the same people. You’re essentially entering into a partnership with these people, so it’s beneficial to get to know everything you can about them.

- Look into local environmental, nuisance, and zoning laws: Make sure your business can legally operate in the building you’re considering leasing.

- Read the fine print: Read every word of every document given to you to sign, and if you don’t understand it or want to negotiate, ask for help from a realtor or lawyer. This can help you avoid problems down the road.

9. Get Organized

Keeping your business organized can seem like a giant task, but if you take some time upfront to establish accounting and record-keeping systems, your business will run smoothly.

You can set up a paper-and-file-box system if your business has a physical location. Or, keep everything digital with one of the business process management tools Quick Sprout recommends.

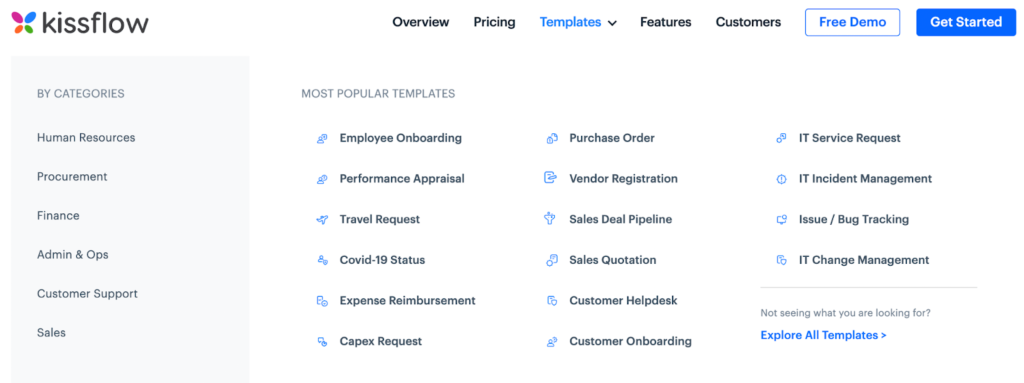

Kissflow is one of our top choices for BPM tools. Here’s a glimpse of the templates it offers to help keep your company organized.

Whether you’re a brick-and-mortar or online business, I recommend using cloud-based software to keep your accounts in order. Software will save you time, energy, and costly mistakes. It’ll streamline important processes like paying employees, keeping track of tax-deductible items, and receiving payments from customers or clients.

Our list of accounting tools for small businesses is a great place to get started on your search for the perfect accounting software.

10. Choose a Business Insurance Plan

Do you plan on hiring employees? The federal government requires any business with employees to obtain worker’s compensation, disability, and unemployment insurance.

Just as you insure your vehicles and home, it’s also smart to insure other aspects of your business. From general liability insurance to home-based business insurance, options abound.

That’s why we recommend taking a look at your business to see what would cost too much money to replace on your own. Once you have a list, find a reputable insurance agent to help you figure out which type of insurance would fit your needs.

You can also take a look at different insurance plans and policies, comparing their costs and coverage. Our list of the top 10 business insurance companies can get you started.

11. Get Your Product Ready

Whether you’re making and selling ice cream, sourcing t-shirts and creating unique prints, or offering custom websites for authors, make sure your product is ready to go. Depending on your business structure and focus, you may also need to interview and hire employees.

Businesses that need an inventory can decide whether to build a safe stock, utilize just-in-time inventory or dropshipping, implement ABC inventory management, or try consignment. Quick Sprout’s list of top inventory software tools can help you manage whatever inventory system you decide to use.

If your company doesn’t require an inventory, make sure you have the software and tools you need to get you and your team ready to sell your products and services.

12. Spread the Word

Before you hop on social media and shout to the rooftops about your new business, take a deep breath. Hire a logo designer to create a logo that represents your brand. Order business cards. Set up an email newsletter for clients and customers to opt into. Build a business or ecommerce website that sparkles.

This part of creating a business can be a lot of fun. Take your time to enjoy it. Make sure you love the marketing material you put together to showcase the business you’re working hard to start.

And then? Go ahead and do it. Share your new company with the world.

https://www.quicksprout.com/business-startup-checklist/

No comments:

Post a Comment