Starting any business is hard, but starting a cannabis business is even harder.

Compared to other industries, marijuana businesses face stricter guidelines with licensing, taxes, compliance, and so much more.

But once you’re able to navigate these rough waters, the potential profits are seemingly limitless.

This guide will explain everything you need to know about starting a cannabis business from scratch.

The Easy Parts of Starting a Cannabis Business

While the marijuana industry is commonly associated with hurdles for business owners, there are actually some easy tasks for marijuana startups as well. Focusing on these quick wins can help you build momentum so you won’t feel as overwhelmed with the challenges lying ahead.

One of the easiest parts of starting a cannabis business is the actual formation process.

There are tons of great online services you can use to legally register your business entity with the state. Whether you’re starting an LLC or a corporation, you can use these services to quickly register your marijuana business and add some liability protection to your operation.

Another positive note about the cannabis industry is its perception and bright future. The stigma attached to marijuana use, whether it be for medical or recreational use, has changed significantly over the years.

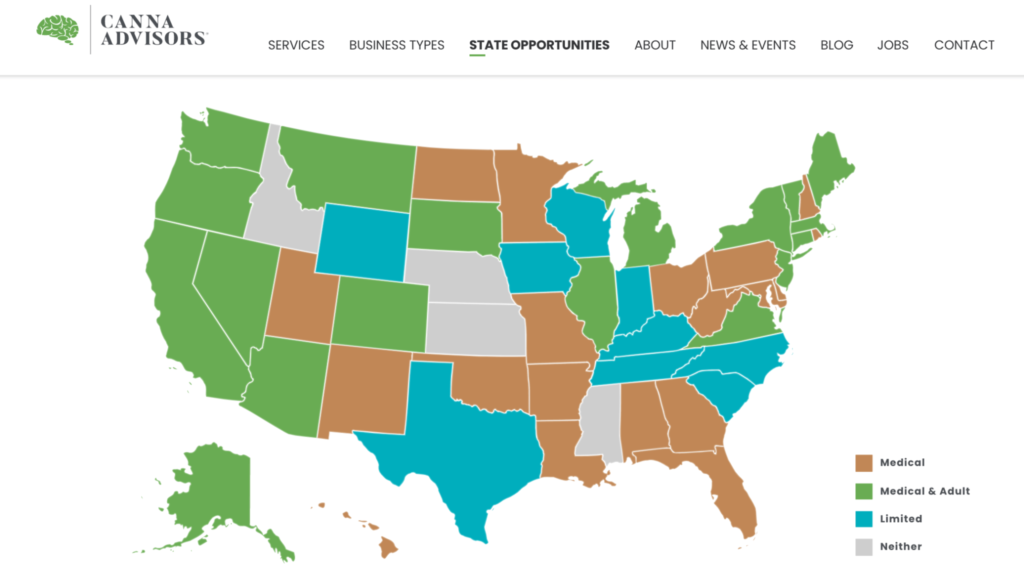

States are adopting more relaxed guidelines for the sale and use of cannabis products.

Most cannabis startups struggle with applying and obtaining the right licenses to legally open and operate their marijuanna businesses. But this process is far less demanding if you seek assistance from cannabis consultants and advisors.

The consultants at Canna Advisors are industry leaders in this category.

Canna Advisors has been paving the way in the cannabis industry since 2013. They are experienced with helping entrepreneurs and startups enter the marijuana industry with as little resistance as possible.

They offer services for cannabis business licenses, facility designs, standardizing operations, and more.

The advisors help you develop a plan that’s tailored to the regulations in your specific state. This drastically increases the chances that your license applications will get approved. The experts have helped win licenses for cannabis startups in 31 states, plus Canada, Europe, Guam, and Puerto Rico.

The Difficult Parts of Starting a Cannabis Business

There’s no way to sugar-coat this—starting a cannabis business has more than its fair share of challenges.

In addition to the strict state guidelines for licenses, there are also significant financial hurdles associated with starting a business in the cannabis industry.

Depending on your state and the type of cannabis business that you’re starting, the initial startup costs can easily get into six-figure territory. According to Leafy, non-refundable application fees can range anywhere from $2,500 to $100,000, with most falling in the $30,000 range.

Licensing fees are even more expensive—ranging from $25,000 to $500,000, with an average of around $200,000. Annual fees associated with registration and renewals will typically run you about $60,000 to $100,000.

In short, you need capital to start a cannabis business. And while this is the case for many startups, it’s much harder for cannabis startups to raise the money required to get started.

It’s highly unlikely that you can borrow money from a bank, credit union, or traditional lender to fund your cannabis startup. Even VCs and investors are hesitant to loan money to a cannabis business because there’s so much risk involved. So if you can find a lender, the interest rates will likely be very high.

Here’s something else to consider—marijuana is still illegal under federal law. These override state and local jurisdictions, meaning the federal government could shut down your operation and charge you with federal violations.

As many banks and financial institutions adhere to federal law, some of these banks don’t want anything to do with money coming from a cannabis business. This means that you could struggle to find a bank that will let you deposit the money your business earns.

Many cannabis businesses have tons of cash that they can’t deposit. While this may sound like a good problem to have, it poses lots of security risks and forces businesses to take extra precautions with guards, security trucks, and the way they transport money.

Step 1 – Decide What Type of Cannabis Business to Start

The cannabis industry is actually quite broad. There are lots of different ways to start a business and make money in an industry that’s poised for growth.

Generally speaking, all of these business types fall into one of two categories—plant-touching and ancillary.

Plant-Touching Cannabis Businesses

As the name implies, plant-touching businesses directly handle cannabis products. This could include raw flowers, edibles, infused products, and more. These types of businesses have much stricter requirements and need to obtain specific state licenses to operate.

Examples of plant-touching cannabis startup categories include:

- Cultivation — Businesses that grow, breed, and harvest cannabis. These businesses typically supply raw flower to dispensaries that sell to end-users or manufacturers that extract THC/CBD from the flower for other products.

- Lab Testing — Lab tests are required to determine the chemical makeup of cannabis plants and products. These tests are typically used to quantify the potency of THC and CBD. Labs also test the quality of products to make sure everything is safe for consumption.

- Distribution — Cannabis distributors transport raw flowers or other cannabis products across the supply chain. These types of businesses could take the flower from a grower and transport it to a manufacturer. Then they take the products made from a manufacturer and transport them to different dispensaries.

- Manufacturing — Cannabis manufacturers extract THC or CBD from flowers and turn them into other products. This could include vape cartridges, topical creams, edibles, and more. Manufacturers don’t sell to end-users but rather to dispensaries.

- Dispensaries — Dispensaries require specific licenses to sell cannabis products to end-users. These products are offered either through brick-and-mortar retail locations or through marijuana delivery services.

- Consumption — Only a few states offer consumption licenses to cannabis businesses. This license allows users to consume products on-site, typically in the form of a lounge, bus, or private venue.

Not all of these will be options for you, depending on the laws in your state.

Ancillary Cannabis Businesses (Non-Plant Touching)

Ancillary businesses associated with the cannabis industry provide products or services that support other cannabis businesses. But they don’t deal directly with cannabis products. Ancillary services are easier to start and may not require as many state licenses.

Examples of ancillary cannabis business include:

- Construction and general contracting for commercial growers

- Products for cannabis packaging (baggies, bottles, containers, etc.)

- Labels for the appropriate cannabis disclosures, depending on the product

- Professional services (accountants, consultants, lawyers, marketers, etc.)

- Technology products for supply chain management, point-of-sale, and more

- Cannabis accessories (vapes, bongs, bowls, grinders, ashtrays, storage boxes, etc.)

- Grow lights and electrical equipment for cultivation

As you can see, these ancillary services can be a great entry point into the cannabis industry, especially for those of you who want to take the path of least residence.

You can use Canna Advisors to learn about state-specific business opportunities in the cannabis industry.

This resource can help you decide whether it makes sense to start a plant-touching or ancillary cannabis business.

Step 2 – Register Your Business Name and Legal Entity

Next, you need to legally register your business with the state of formation.

Not only is this a step towards putting yourself in good standing with the state, but it also helps provide liability protection to you as a business owner. If someone sues your business or the company goes bankrupt, an LLC or corporation can help shield your personal assets from being lost.

Run a Business Name Search

Start by coming up with a name for your cannabis business. You can search that name through a state database to see if someone else has already registered that name.

Alternatively, you can use a generic business name to give yourself opportunities for growth. Then you can apply for a DBA (doing business as) name for operational purposes.

For example, the legal name of your business might be “Highland Holdings LLC.” But you can register a DBA as “John’s Marijuana Dispensary,” or something like that.

File Business Formation Papers With Your State

Depending on the entity type you want to create, you’ll need to file specific papers with the secretary of state’s office. The exact process and forms will vary from state to state.

To make your life easier, just use a business formation service.

Online services like Incfile, ZenBusiness, LegalZoom, Rocket Lawyer, and MyCorporation are just a handful of examples to consider. These services fill out the proper forms and file paperwork with the state on your behalf. This speeds up the formation process while ensuring compliance for each step.

Most of these platforms also offer registered agent services, EINs, and more—all of which you’ll need to legally form your cannabis business entity.

Step 3 – Apply For Cannabis Business Permits and Licenses

Now comes the difficult part.

Proper licensing and business permits are essential for cannabis businesses that are touching the plant. If you’re selling products to end-users, this is also going to be an important step for compliance.

Research State Guidelines

The exact requirements and permits vary from state to state. Regulations are constantly changing, which can make it tough to find the latest and most accurate information on what’s required.

That’s why I recommend using a consultancy service like Canna Advisors.

Canna Advisors will walk you through the licensing process for your specific state.

Every detail of applications for a cannabis business license is scrutinized. One small mistake could lead to a rejection, and you may not get another opportunity.

Lots of applications require significant fees that are non-refundable. So it’s a big waste of time and money if you get rejected. Some states don’t issue new licenses to applicants all the time. You might have to wait a year or so to even apply.

There are also some state-specific rules with unique licensing requirements, such as dispensaries that can only sell products that have been grown themselves.

Examples of state licenses include:

- Type 1: Specialty Small Cultivation

- Type 2: Small Cultivation

- Type 3: Medium Cultivation

- Type 4: Nursery Cultivation

- Type 6: Manufacturer 1 (Non-Volatilemarijuana Solvents)

- Type 7: Manufacturer 2 (Volatile Solvents)

- Type 8: Testing Laboratory

- Type 10: Dispensary

- Type 11: Distribution

- Type 12: Transporter

Then there are subcategories within each type, like Type 1: Outdoor, Type 1A: Indoor, Type 1B: Mixed Light, and so on.

Step 4 – Figure Out Your Tax Obligations

Of all the industries nationwide, cannabis is one of the highest-taxed. Similar to other businesses, you’ll have to pay state, federal, and local taxes to remain compliant.

But the way cannabis companies are taxed has a significant impact on the cost of doing business.

That’s because a cannabis business cannot write off typical business expenses that would normally be deductible in other industries. This is due to Section 280E of the IRS tax code—because marijuana is still considered a Schedule 1 drug by the federal Controlled Substances Act.

In short, cannabis businesses pay taxes on gross income—not gross income less deductible expenses.

Let’s say your cannabis business does $2 million in revenue with $1.5 million COGS for a $500,000 gross income. You’re going to pay taxes on the full $500,000 without any deductions.

Step 5 – Focus on Branding and Growth

Once you’ve obtained your licenses, permits and you’re ready to start conducting business, it’s time to start planning for the future.

Whether you’re doing wholesale growing, manufacturing, or opening a dispensary, you’ll need to brand your cannabis business, just like any other startup.

If you’re starting a dispensary, you should have goals to be the next Starbucks of the cannabis world or a similar analogy.

The consulting team at Canna Advisors has services for cannabis branding and business development.

They’ll help you with an industry market analysis, operations plans, financial planning, long-term marketing, and more.

You can use them for coming up with unique brand packaging that’s both educational to consumers and compliant with state regulations, FDA, and the GMP.

Canna Advisors has everything you need during the initial startup process through the brand development stages of your operation—ensuring success for the future.

No comments:

Post a Comment