Payroll is often an underappreciated career involving long hours, weekends working, and short holidays. Payroll personnel must deal with constantly changing payroll regulations and adhere to federal, state, and local payroll laws in addition to company policy. Payroll certification lets employers and potential employers know that you are competent and up-to-date with payroll laws, regulations, and procedures.

What is Payroll Certification?

Payroll certification is a type of designation awarded to payroll specialists or coordinators after passing a certification exam. This designation proves that the individual has advanced knowledge, skills, and competence in payroll, payroll software, and relevant payroll legislation.

Although there are multiple institutions offering payroll certification, the American Payroll Association (APA) is the de facto issuer of payroll certification. This national payroll certification body has more than 20,000 members. Currently, the APA offers two types of accreditation, which we will explore in the next section.

The Basics of Payroll Certification

The American Payroll Association offers two certifications to cater to different levels of payroll knowledge and professional experience.

Fundamental Payroll Certification (FPC)

The Fundamental Payroll Certification primarily targets entry-level payroll professionals or personnel in positions requiring payroll knowledge. Other professionals who typically take this exam include:

- System engineers or analysts supporting payroll systems

- Sales professionals and consultants working in the payroll industry

- Client representatives for payroll service providers

The FPC is an entry-level certification in the best sense. There are no eligibility requirements to take this exam. Initially, payroll professionals could only get the Certified Payroll Professional certification. But, the APA recognized the disparity in knowledge and length of experience in the payroll community and developed the Fundamental Payroll Certification to even out the playing field.

The FPC examination covers payroll fundamentals, including Professional Payroll Skills and Responsibilities, Tax Reporting and Accounting, and Paycheck Concepts. The exam is administered electronically online and at Pearson VUE testing centers. It includes 150 multiple-choice questions. Candidates have three hours to complete the exam.

The exam fee is $320 for APA members and $395 for non-members. You’ll have the pleasure of using the FPC designation after your name after passing the exam.

Certified Payroll Professional (CPP)

The Certified Payroll Professional (CPP) certification is for professionals looking to advance in their field. The CPP is for people with extensive payroll knowledge and experience. You’ll need to meet one of the criteria mentioned below to be eligible to take the exam:

- At least three years experience in the practice of payroll in the five years preceding the date of the examination

- Employed in the practice of payroll for at least two years and completed courses offered by the APA

- Obtained the FPC designation, employed in the practice of payroll for at least 18 months, and completed courses offered by the APA

The CPP exam costs $380 for APA members and $550 for non-members. The exam includes 190 multiple-choice questions, and candidates have four hours to complete it. Some of the topics covered in the exam include:

- Core Payroll Concepts

- Calculation of the Paycheck

- Compliance/Research and Resources

- Audit

- Payroll Administration and Management

- Accounting

Once again, you’ll be able to use the CPP designation after your name when you pass the exam. It’s worth mentioning that you can only use one title at a time. You’ll need to drop the FPC designation and use only the CPP after your name if you’ve passed both certification exams.

3 Tools To Improve Your Chances of Earning Payroll Certification

Many people who have taken payroll certification exams agree that it can be difficult. However, the effort will pay off when you are more attractive in the job market, demonstrate competence in your role, and work with complex payroll software and systems. Below are a few tools to increase the chances of passing your certification exam on the first try.

1. APA Candidate Handbook

The logical place to start is to familiarize yourself with the examination process. The American Payroll Association offers a free candidate handbook for each of its certification exams. The handbook covers everything you need to know about taking the exam, including the contents and format of the exam, eligibility requirements, how to register for the exam, how to pay, examination windows, and what to bring to the exam.

You can download the FPC Candidate Handbook and CPP Candidate Handbook from the APA website. You’ll only need to fill in a few details, including your name and email, and the APA will provide you the relevant handbook for free.

Be sure to read the handbook thoroughly before you apply for the exam. It contains crucial information that could determine whether or not you can take the exam. The handbook can also help you figure out whether you are ready to take the exam.

2. PayTrain

PayTrain is a comprehensive payroll study guide by the American Payroll Association. The curriculum is drawn mainly from the CPP exam, so it’s hard to imagine a more complete study tool than this one. The platform lets you take a self-assessment test to determine your current payroll knowledge. Then, you have access to 12 course topics, including Payroll Concepts, Calculations of Deductions and Net Pay, Payroll Reporting and Employment Taxes, and Payroll Administration and Management.

PayTrain also comes with a full suite of interactive study tools to cater to all learning styles. These resources include:

- Assessments

- Exercises

- Calculations

- Module Quizzes

- Glossary

- Flashcards

- Games

- Reports

- Post Tests

- Resource Center

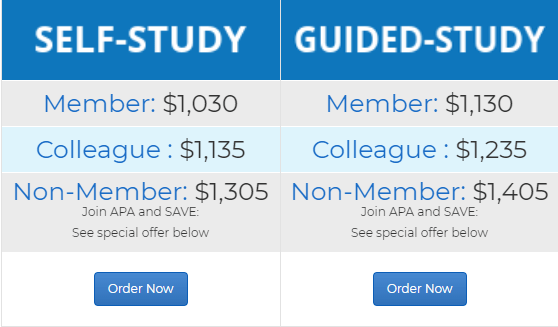

Pricing starts at $1,030 for APA members and $1,305 for non-members. You have the option to self-study or pay a little more for guided study. You get access to the online platform until September of the following year when you sign up.

3. APA Payroll Source®

The Payroll Source® is the APA’s payroll body of knowledge. This book covers all aspects of payroll administration, starting with the basics to the most complex concepts such as international Payrolls and Benefits Taxation and Reporting. Payroll Source is also an approved study tool for your CPP exam.

The best part about getting the Payroll Source is that you’ll use it long after you have passed your certifications. Over your career, you will face challenging payroll questions and scenarios. For example, a C-suite executive may want to know why their bonus check is taxed at such a high-income rate. This guide is handy to have by your desk when you need to provide clear and accurate answers to payroll questions and concerns.

As more and more professionals rely on payroll software, this guide also helps ensure that you use the software properly. Technology is only as good as the person operating it. Knowledge gaps, misunderstandings, and outdated information on your part may render even the most sophisticated payroll software inaccurate.

8 Tricks for Passing Your Payroll Certification Exam

Aside from taking advantage of the tools mentioned in the section above, there are a few more practical tips that you can use to give yourself the best chance of passing your certification exam.

1. Create A Study Schedule

You’ll repeatedly hear from people who have taken the payroll certification exam that the test requires a lot of studying. These exams aren’t the type you can just memorize everything overnight and take the test in the morning. Create a structured study schedule and follow it religiously. If possible, set aside at least an hour every day to study.

Most people need between six and eight weeks to prepare adequately for the CPP exam. And be sure to study the math questions.

2. Review the Candidate Handbook

Contrary to what some people might have you believe, the APA wants you to pass the exam. That’s why the FPC and CPP handbooks contain a complete breakdown of the examination. This includes the contents of the exam and the approximate weight of each section.

Take the CPP exam, for example. The Core Payroll Concepts topic counts for 27% of the total score, while Calculation of the Paycheck accounts for 20%. This information should give you a good idea of what to expect in the exam room and where to focus your time.

3. Space Out Your Study Time

Many learners rely on cramming, but this study technique is inefficient. Instead, space out your study sessions. Distributed or spaced practice, as it is called, helps with memory, problem-solving, and other aspects of learning.

Studying for thirty minutes to an hour every day will yield better results than studying for four or five hours twice a week. Since you already know which exam topics carry the most weight, you can appropriately schedule your study time and topics.

4. Consider Instructor-Led Training

While there are free training courses out there, it’s hard to beat instructor-led training. Guided training by subject-matter experts gives you the best chance of earning your certification on the first try. These experts also bring real-world experience to the training, which is invaluable during the exam and after earning your certification.

You may even find that some instructors play a hand in developing content for the certification exams. You can hardly go wrong with training programs offered by the APA. Should you choose a different route, just make sure the training program is APA-approved.

5. Don’t Rely on a Single Resource

The payroll industry is constantly changing and evolving, and information becomes outdated quickly. Relying on only one source can be risky. There are plenty of resources out there to help you pass your certification exam. These include free study guides, paid courses, textbooks, webinars, podcasts, online lectures, and more.

Scour the internet and find as many resources as you can. Using multiple resources ensures that you are well-rounded and adequately prepared for the exam.

6. Take Practice Tests

Practice tests are great for identifying knowledge gaps and areas of improvement. Most FPC and CPP courses already come with practice tests to gauge your knowledge. Additionally, platforms such as Mometrix offer full-length practice tests. You might also be able to get some online for free.

Be sure to take the full-length practice tests. These exams can go up to four hours, so it helps mentally prepare you for taking the exam. Take practice tests both throughout your studying to identify knowledge gaps and again just before the actual exam for the best results.

7. Consider Becoming an APA Member

You don’t have to be an APA member to sit for its payroll certifications exams. Still, this is an option worth considering seriously. Some of the benefits you enjoy as a member include:

- Receiving the latest payroll compliance news and updates

- Get all your payroll questions answered by professionals

- Network with other payroll professionals

- Get access to the APA’s monthly podcast, PayTalk

- Receive discounts on certification exams, online training, conferences, webinars, and publications

- Free events, webinars, and eBooks

- Receive three Recertification Credit Hours (RCHs) every year

APA membership costs $262 annually. New members also pay a $35 enrolment fee.

8. Prepare for Exam Day

Get a full night’s sleep the day before the exam. Try not to stay up late cramming, or you may wake up tired and disoriented. If you followed a structured study timetable, you have nothing to worry about on exam day.

Arrive at the test center early to get the formalities out of the way. You will likely have to provide identification and fill out paperwork. Preferably, drive to the test center before the exam, so you are familiar with the route, parking arrangements, and other incidentals that could potentially take more time than you budgeted. If you’re taking the exam online, test your equipment beforehand to make sure everything works correctly.

Finally, there’s a good chance that you won’t know everything in the exam. This is perfectly normal, and you don’t need perfect scores to become certified. Relax, answer the questions carefully, and do your best!

What to Do Next

Once you’re certified, you’ll be free to use the FPC or CPP designation next to your name. However, your certification is only valid for five years, after which you have to go through recertification. You can maintain your certification either by meeting the APA’s continuing education requirements or retaking the exam in the same year your certificate expires.

These continuing education hours are tracked as Recertification Credit Hours or RCHs. You can earn your recertification credit hours by attending in-person educational activities such as seminars, courses, educational events, and live webinars conducted by the APA or its affiliates. For the FPC, you will need 60 RCHs over the three years of the certification, and the CPP requires 120 RCHs over five years.

The APA also accepts programs organized by other institutions. However, you’ll need pre-approval from the APA before submitting these RCHs towards your certification. You do not need to provide proof of attendance. But, the APA conducts random audits where you may be requested to provide such evidence.

No comments:

Post a Comment