Building a business can be incredibly exciting—until you hit the legal part.

When you start a business, you have to make the monumental decision of selecting a business structure. This is where you decide the type of legal structure you want for your company, which also determines the tax you pay and how you pay it.

It’ll affect the amount of paperwork your business needs to do, the extent of your liability, and your ability to raise money.

The good news is you don’t need an MBA to understand this. Things are very straightforward when explained correctly. Read on as I decode common business structure basics, along with a few useful tools and tips to set you up for success.

What is a Business Structure?

A business of structure indicates an organization‘s structure as it is recognized in a given jurisdiction.

Choosing a business structure creates a legal recognition for your trade, where it becomes a key determinant of the activities your business can undertake, including raising capital, paying taxes, and the responsibility for the business’s obligations.

Your business structure trickles down to several factors that are part and parcel of running a business. In addition to enlightening the legal documentation you need, it also clarifies the amount of taxes your organization owes to tax agencies. More importantly, it decides the extent of your liabilities on behalf of the business.

Precisely why before choosing your legal structure, you should carefully consider your needs and goals and understand the features of every business structure.

The Basics of Business Structures

In the section, I’ll detail the basis of common business structures. By the end, hopefully, you will have a fair idea about which option would be better suited for you.

Sole Proprietorship

The sole proprietorship is the simplest business structure, involving one individual who owns and operates the enterprise. Any organization that isn’t registered as otherwise is considered as a sole proprietorship.

For instance, if you make and sell jewelry on Amazon and your website, you’re a sole proprietor. So if you plan to work alone and want total control over operations, this is right up your alley.

But that doesn’t mean there are no legal obligations. You have to figure out the licensing, permits, and regulatory hoops depending on the industry.

A sole proprietorship is appealing for tax purposes because all the income and expenses from the business are included on your personal income tax return, Form 1040. Your profit and losses are then recorded on a form called Schedule C, which you’ll file with your 1040.

From here, the “bottom-line amount” is transferred to your personal tax return. You must also file a Schedule SE with Form 1040.

Sole Proprietorship Pointers

- It’s relatively inexpensive—provided you don’t need to file for a DBA (Doing Business As).

- Being a “pass-through” tax entity where all the profits and losses come straight to you (the owner), paying taxes is relatively easy.

- You can have employees if you want. However, this will complicate your taxes a bit.

- Raising money and getting a small business loan will be difficult.

- You have to assume full responsibility for your business’s debts and obligations.

Partnership

When your business is owned and operated by two or more individuals, it becomes a partnership. Generally, partnerships can be of two kinds: General partnerships and Limited partnerships.

When you’re part of a general partnership, you and the other partners in the company assume full responsibility for the business’s debts and other obligations.

In a limited partnership, there are general partners and limited partners. While the general partners operate the business and are personally liable for the partnership, limited partners are strictly investors. Limited partners have no control over the company and don’t share the same liabilities as general partners.

Let’s explain this with the jewelry selling example on Amazon.

If you bring in your best friend who is equally as good as you in creating jewelry, you won’t be a sole proprietorship anymore—your business is now a partnership.

On the tax front, partnerships have it relatively easy. A partnership business isn’t required to pay tax on its income and is considered a pass-through entity, where any profits or losses are extended to the individual partners. During the tax season, the partnership files a tax return (Form 1065) to report its income and loss to the IRS.

Additionally, every partner has to report their share of income and loss on Schedule K-1 of Form 1065.

Partnership Pointers

- There must be an official partnership agreement between the partners.

- A partnership is a pass-through tax entity, where all profits and losses “passed through” to the partners.

- Partners must stay true to each other and have a trusting relationship.

- It’s possible to have a one-off partnership known as a joint venture. In this case, you partner with other individuals for one specific project.

Corporations

A corporation is the first thing that comes to mind when people think of a business structure. It has a complex legal structure comprising shareholders, which also makes tax requirements more intricate and stringent.

There are three different types of corporations: C-Corp, S-Corp, and B-Corp. Each type has its own set of distinct characteristics.

C Corporation or C-Corp refers to the structure where all shareholders combine funds in exchange for stock in a newly formed business. It‘s an independent tax entity in the eyes of the IRS, which means it can file taxes in its name and will get tax deductions.

This business structure has a unique double taxation situation. In addition to the corporation paying corporate income tax at the federal and state level, its owners have to pay personal income tax on any earnings they receive from the business.

S Corporation or S-Corp is similar to a C-Corp except in the tax aspect. In an S-Corp, all income and losses are passed through to shareholders and included in their individual tax returns. As such, there’s just one layer of federal tax that owners must pay.

In other words, you can take your share of profit home without deducting the corporation’s share of tax—something important in the case of C-Corps.

That said, becoming an S-Corp isn’t easy. You have to set your business up as a corporation within your state and then request an S-Corp status (Form 2553).

B Corporation or B-Corp simply means benefit corporation. This can be a viable business structure if your company has a dedicated social mission, with a good cause built into its foundation that you plan to continue pursuing as your company grows.

A B-Corp is just a regular C-Corp that has been vetted and approved for the B-Corp status. Many people prefer to be a B-Corp over a non-profit because of ownership terms. With a non-profit, there are no owners or shareholders, whereas, for a B-Corp, there are still some shareholders who actually own the company.

Corporation Pointers

- Corporations offer higher protection for personal assets as the liability is mostly limited.

- There’s greater potential to raise capital.

- Corporate taxes are filed separately from personal taxes, making the business eligible for corporate tax breaks.

- Corporations are more difficult to set up.

- A traditional C-Corp has a double taxation factor.

- B-Corporations must have a social mission and require vetting to receive the status.

Limited Liability Corporation

A limited liability corporation or LLC combines the best of both worlds. You get the flexibility of a partnership with the liability protection of a corporation. The earnings and losses pass through to the owners and are included on their personal tax returns.

An LLC is similar to an S-Corp—but with more attractions.

It offers a combination of legal liability limitation and favorable tax treatment for profit and its transfer. You can have as many shareholders for an LLC as an S-Corp, which has a limit of 100. It’s a new form of legal entity that varies a lot from one state to another. As such, the advisability and benefits of forming this business structure also vary.

Limited Liability Corporation Pointers

- Starting an LLC is more complex as you have to adhere to stringent rules and regulations.

- LLCs provide personal asset protection to the owner. If sued, they can only go after business assets, not personal property or money.

- An LLC is a pass-through tax entity for federal income taxes and enjoy greater tax incentives.

- An LLC is a good alternative to a sole proprietorship. Except for Massachusetts, you can form a single-member LLC.

3 Tools to Help Start Your Business

I’m going to go ahead and assume you plan on starting a business. Congratulations!

At the same time, you have to be prepared for the never-ending paperwork, legal assistance, and several other steps to kickstart your business. Check out our buying guide for in-depth reviews of the top 11 business formation services today. Below, I have listed three of the best business formation services that can do all the hard work for you, regardless of whether you want to create a single-member LLC, multi-member S-Corp, partnership, or a non-profit.

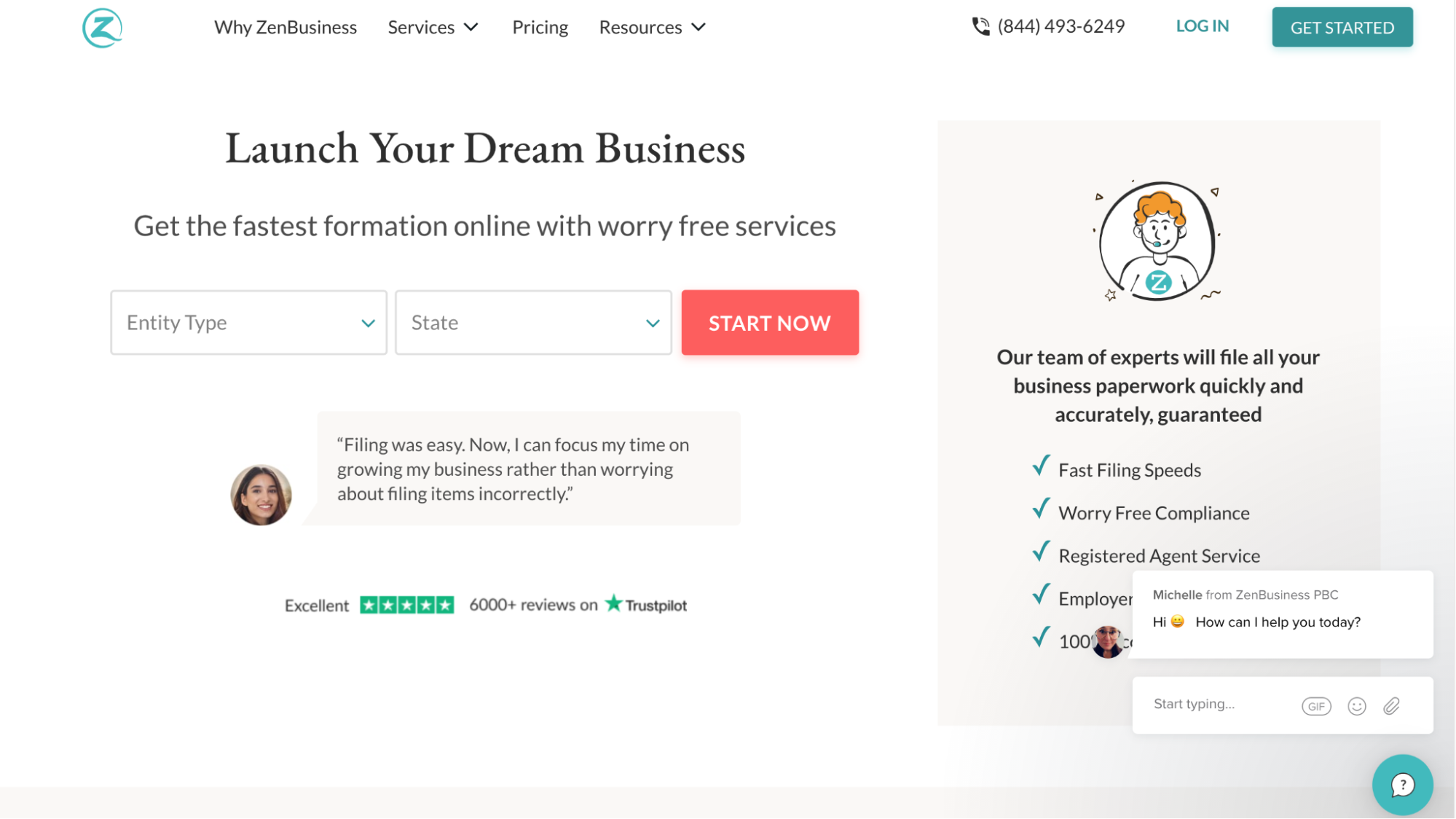

ZenBusiness

ZenBusiness is fast, reliable, and diverse. It comes with a wide range of offerings that include incorporation services, LLC services, registered agent services, and DBA.

It comes with a user-friendly interface, which makes it suitable for beginners. However, its biggest USP is arguably the worry-free guarantee that includes two amendments to yearly corporate annual reports.

The other reason why I like ZenBusiness is its affordability. A $39 price point and a free year of registered agent service and accounting assessment—in addition to incorporation—make it even more attractive.

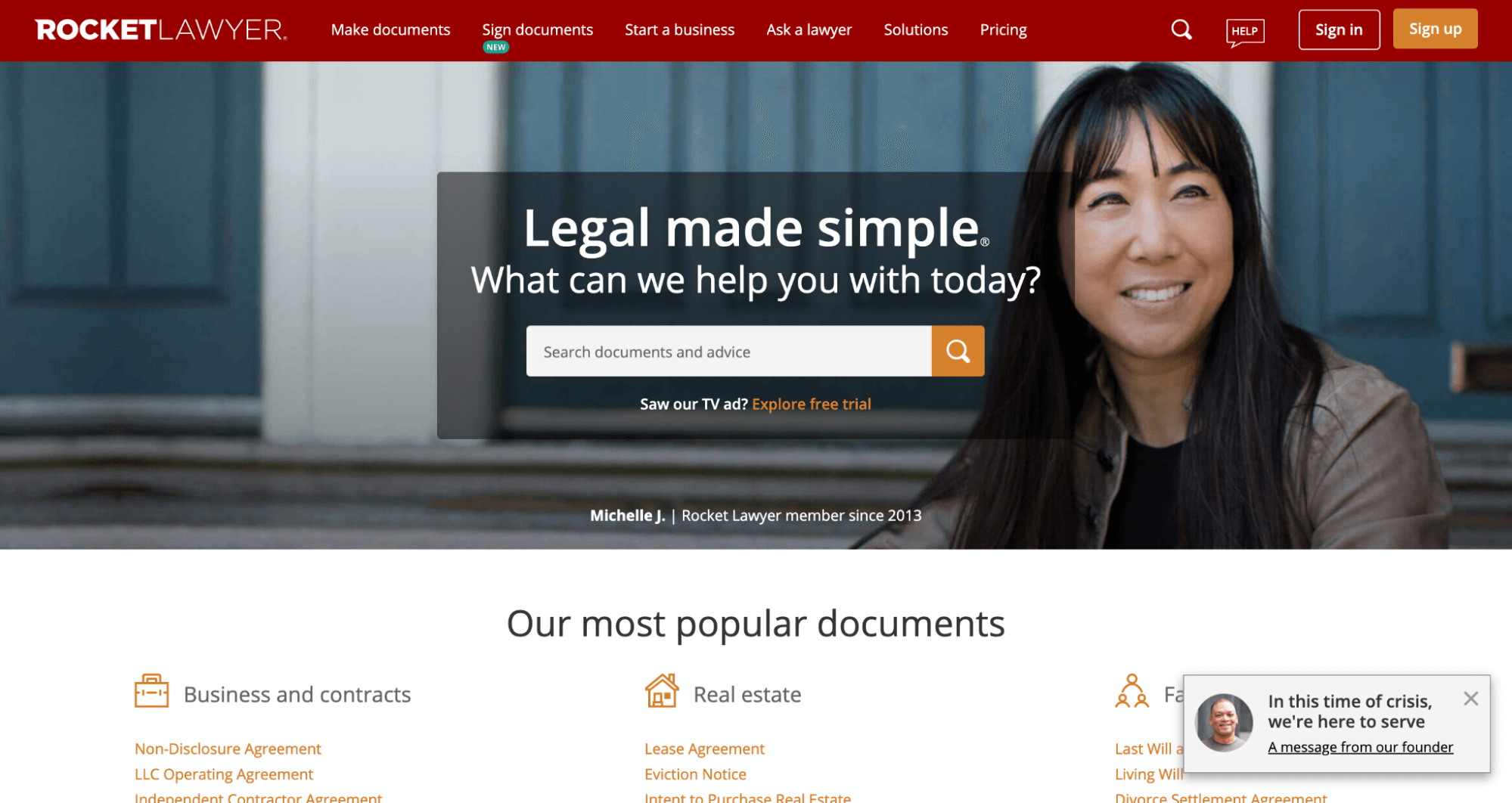

Rocket Lawyer

Rocket Lawyer tries to provide the average person a reliable legal service without breaking the bank, and it delivers.

Signing up for this service gives you access to experienced attorneys who can answer all your legal queries within minutes. In addition, it has a lawyer directory that instantly connects you with an expert on a specific legal topic from your chosen state for the best possible guidance.

What’s more, you can contact your assigned lawyer whenever you want during the business incorporation process via call, mail, or chat. The fact you get post-launch care is another hard-to-miss benefit.

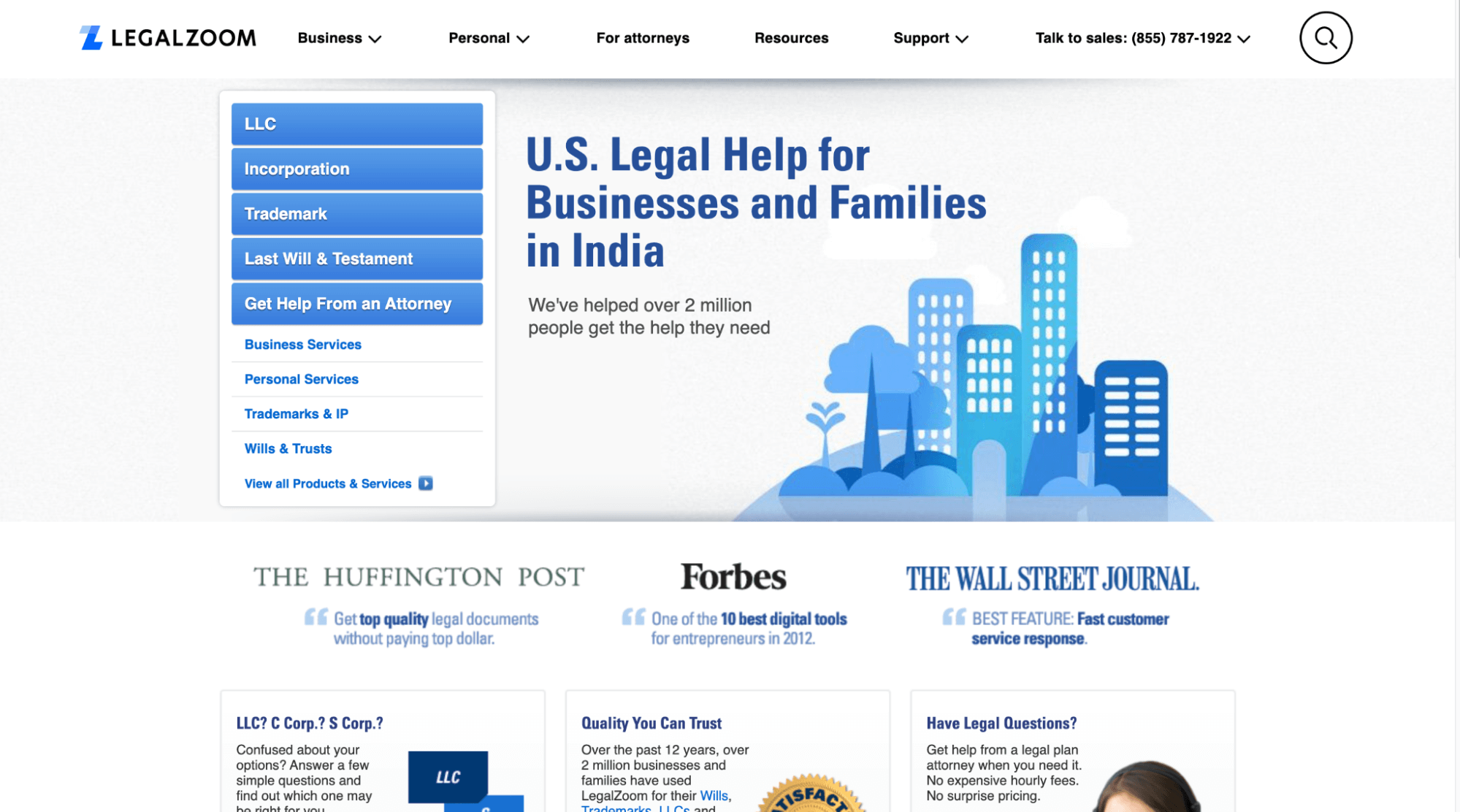

LegalZoom

LegalZoom is one the most popular business formation services that offer comprehensive legal assistance in all 50 U.S. states.

It has one of the most extensive lists of service offerings that are customized based on your business requirements. You’re directly paired with attorneys who can give personalized advice related to your business structure.

Additionally, LegalZoom offers various services like procuring seller’s permits, business licenses, EIN, state tax ID, and 501(c)(3) applications.

3 Tricks for Deciding the Best Business Structure for You

It’s not always easy to decide which structure would be most suitable for you, especially since there are several factors to consider.

Consider How Complex and Flexible You Want Your Business to Be

As mentioned before, nothing is more straightforward than a sole proprietorship. All you have to do is simply register your name, start your business, report profits and pay

Partnerships need a signed agreement that clearly outlines the roles of every partner, along with their profit percentages. Out of these, corporations and LLCs are more complex since they have different reporting requirements from the state and federal governments.

As for flexibility, your business structure should reflect the kind of growth you envision for your business. Take a long, hard look at your business plan where you’ve mentioned your long-term goals. Select a structure that aligns best with those objectives.

Think About Taxes, Licences, and Permits

LLC owners and sole proprietors are all liable to pay tax on profit considered personal income at the end of the year. On the other hand, corporation owners only have to file tax returns on behalf of the corporation as well as for all their personal returns through the business for the specific year.

Individuals in a partnership may also claim their share of profits as personal income.

In addition to taxes, you should also be mindful of whether you need specific licenses and permits to operate. This depends on the type of business and activities you indulge in, leading you to be licensed on the local, state, and federal levels.

Therefore, it’s best to determine the ongoing regulation concerning licenses and permits before you start operating.

Know the Level of Control You’re Willing to Give

If the sole control of your business activity is important to you, opting for a brighter ship or an LLC is your best bet. Furthermore, you can also negotiate this control when setting up a partnership agreement.

However, this isn’t possible in the case of a corporation. This business structure is constructed to have a board of directors responsible for making all the major decisions. You can, of course, have a single person control the corporation at its inception, but as it grows, so will its need to operate the business as a board-directed entity.

What to Do Next

Once you zero on a business structure for your company, it’s all action from there.

Start by signing up with a reliable business formation service to file the necessary paperwork. Once your company has been formed, you can then focus your efforts on getting more business.

Here are a few more QuickSprout guides to ensure your business’s success:

- How to Start a Business in 24 steps

- How to Write a Business Plan for Your Startup

- The 7 Best Online Legal Services – 2021 Review

No comments:

Post a Comment