Running a restaurant can be a payroll nightmare, with dozens or even hundreds of shift hours, shift changes, overtime, and tips to keep track of, sometimes across multiple locations. Thankfully, there’s payroll software specific to restaurant’s needs that can easily help you ensure you’re paying your employees accurately and on time each month—and some are even free. Today, we dive into the best restaurant payroll software tools so you’re ready to make your best choice.

The Top 5 Best Restaurant Payroll Software

- Toast – Best all-in-one POS and payroll system

- Gusto – Best for automated payroll

- Square Payroll – Best for seasonal restaurants

- Restaurant365 – Best for large, established eateries

- Payroll4free– Best free payroll option

Here’s a closer look at each software and what makes each of them stand out.

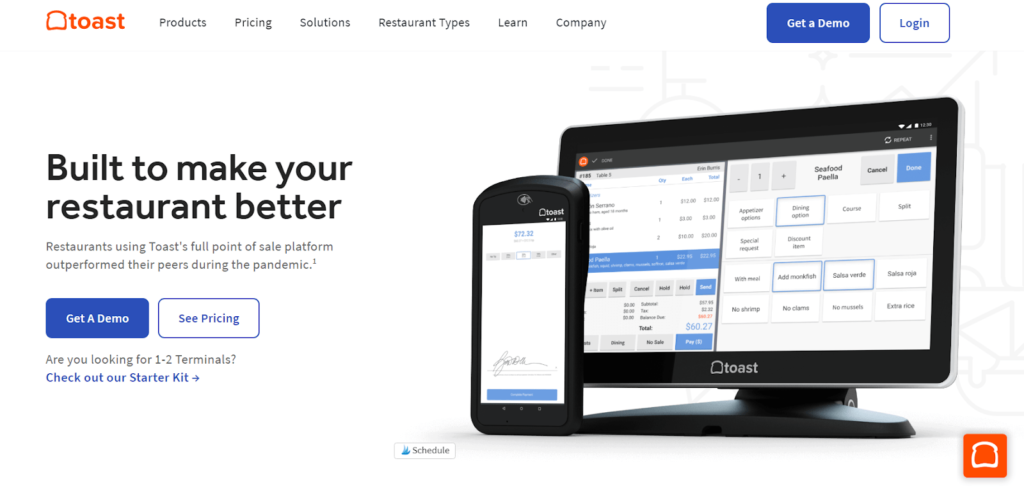

#1 – Toast — Best All-In-One POS and Payroll System

- Handle POS and payroll in the same software

- Automatically record credit card tips

- Employee self-onboarding included

- Free version available

An all-in-one restaurant solution like Toast is perfect if you’re looking for software that covers your point-of-sale system needs, employee payroll, and even employee self-onboarding.

Now, that seems like a lot to unpack. If you’re a smaller restaurant that’s just starting out, Toast might not be for you. However, if you’re a manager juggling a group of employees in the double digits and it’s taking you hours at a time to figure out accurate payroll, Toast helps you make the process a lot easier so you can focus on growing the restaurant.

As far as running a whole restaurant goes, Toast is a robust solution that connects everything from your POS system to your back-of-house inventory count, your online ordering system, and yes, your employee payroll too. With Toast’s payroll system you’re able to automatically keep track of when your employees punch in and out. You’re also able to automatically record hourly wages and credit card tips for each employee as your customers check out.

Are you constantly onboarding new employees? Toast takes the stress out of it by enabling employees to onboard themselves online once they set up a profile and fill out all the necessary HR paperwork.

Here is what the Toast pricing looks like:

- Starter – Free depending on the add-ons you’d like (does not include payroll software)

- Essential – Starting at $165 per month

- Growth – Starting at $272 per month

Toast offers a free tier for small restaurants that need to get up and running, though notice that it does not include payroll software. It’s not until you get to the Essential tier at $165 a month that you can get the Toast software with access to its payroll functionalities.

You can either get started with Toast here or watch a demo first.

#2 – Gusto — Best For Automated Payroll

- Fully automated payments for all types of employees

- Auto-files state and federal taxes

- Automatically transitions you from your old system

- Streamlined onboarding process included

Your restaurant might not need a robust payroll system, but it very well might need one that automates everything so you don’t have to think about payroll constantly. That’s where Gusto comes in as a prominent option.

Better yet, if you’re jumping ship from another payroll system, Gusto can even help you make that transition by taking care of it for you. Once you’re onboarded, you’ll have access to handy onboarding checklists, so you ensure each of your employees is in the payroll system and ready to go.

Gusto even automatically files your state and federal taxes when the time comes—and it sends you automated reminders if tax laws in your state happen to change. This makes filing taxes easy, as Gusto doesn’t charge for this service since it’s already included in its pricing.

With Gusto, you also don’t have to worry about keeping accurate track of deductions, hourly or salary wages, or payday deposits, as it automatically pays every employee registered in your payroll system. Once you’ve set up and customized how you want to run your payroll system, Gusto quietly runs in the background as you take care of the running of your restaurant.

Pricing levels for Gusto:

- Core – $39 per month base price plus $6 a month per person

- Complete – $39 per month base price plus $12 a month per person

- Concierge – $149 per month base price plus $12 a month per person

With Gusto, the most convenient tier for your restaurant will depend on the features you’d like access to, since you’ll have to pay a fee per employee regardless of the tier you choose. Core, its starter tier at $39 a month, comes with access to full-service payroll, full health benefits administration, accounting, and time tracking, as well as employee self-service.

It’s definitely a good place to start. Once you’re in need of more features, you can always level up. Ready to try Gusto? You can try their demo or if you’re ready to dive in, sign up now.

#3 – Square Payroll — Best For Seasonal Restaurants

- Contractors-only plan available

- Track permanent and contract employees in one dashboard

- No inactivity penalty during off-season

- No limit on number of payments each month

Are you running a seasonal restaurant that works with contract employees? Square Payroll has features that make contract payroll tracking an easy process. With payroll, you already know you have to track employee hours, timecards, taxes, tips, and more. Square Payroll takes care of this for you whether your employees are permanent or contractors in one centralized dashboard.

Square Payroll ensures you’re accurately taking care of contract payroll by automatically filing forms like 1099-MISC for you and letting your contractors set up direct deposit. Once your contractors download the Square app, they can clock in and out right from their phones and you can import their hours onto your system seamlessly. Do they want to see their payroll history? All of that information is available to them right on the app.

With Square, you can also choose when you pay your contractors, with no limits to the number of times you pay throughout the month. Moreover, if you’re ever stuck at any step of the process, Square Payroll has a team of US-based payroll support specialists standing by to answer any of your questions.

Pricing options for Square Payroll:

- Pay Employees & Contractors – $29 monthly subscription fee, plus a $5 monthly fee per person paid

- Pay Contractors Only – $5 monthly fee per person paid

Square Payroll’s pricing is pretty straightforward. For a $29 monthly fee, plus an additional $5 fee per employee, you get access to features like unlimited pay runs per month, automatic payroll tax calculations, time cards, and an employee app, and even live support to help you set up your account.

If your mobile restaurant is seasonal, Square doesn’t charge you for inactivity. Square Payroll is a great option if you’re already using other Square software, as it all integrates to work together in the background while you run your mobile eatery.

Ready? Get started with Square Payroll here.

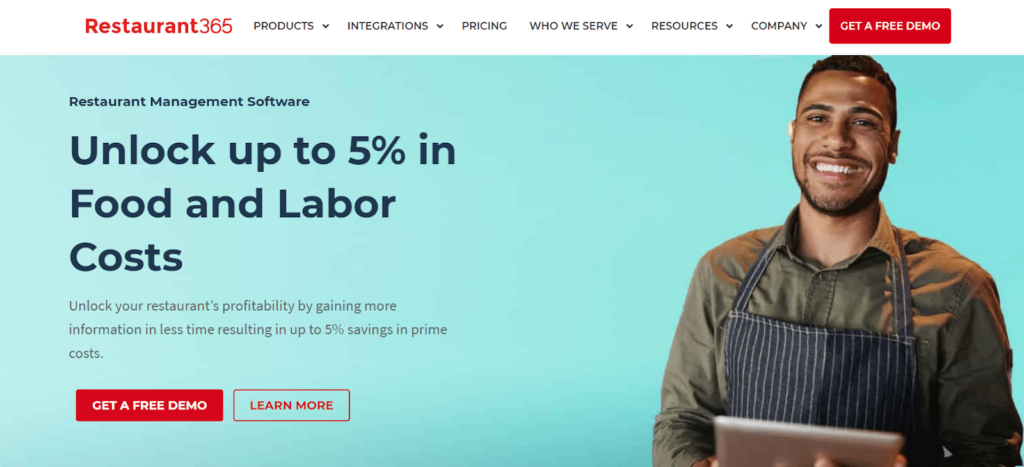

#4 – Restaurant365 — Best For Large, Established Eateries

- Save up to 5% in labor and food costs

- Robust hiring features

- Employee self-service and self-onboarding included

- Four payroll plans

Larger, well-established restaurants need payroll help, too! If you run one of those, Restaurant365 helps you take care of more than just the basics, regardless if you’re an independent restaurant, a multi-concept restaurant, or even a franchisee group.

Fast-paced restaurants juggling a ton of employees can take advantage of Restaurant365’s onboarding and hiring features that ensure you’re making the best decision with its built-in applicant tracking system. Once you’ve onboarded your employees and their paydays, you can be sure your payment calculations are error-free because of the software’s automated workflows and validation rules.

Restaurant365 also offers timely tax table updates, wage garnishment services, overtime pay, and tip-to-minimum calculations. Its payroll tools come integrated with HR features, so while your new employees can get onboarded by filling in all the necessary information through a self-service portal, they can also have access to payroll information that they can configure as needed.

These are the four pricing tiers:

- Core Operations – $249 per location per month – Helps restaurants control food costs and optimize labor

- Core Accounting – $249 per location per month – Helps restaurants grow efficiency by bringing back-office systems together

- Essential – $369 per location per month – Enables restaurants to grow profitability with a complete suite of solutions

- Professional – $459 per location per month – Empowers restaurants looking to simplify systems with its all-in-one platform

With Restaurant365, each tier is specifically crafted around a general goal, as outlined above. For instance, if your restaurant is at a place where it needs to streamline efficiency, the Core Accounting tier can help you make that goal a reality by enabling you to bring together back-office systems.

On the other hand, if you’re looking to simplify processes once you have a working system down, the Professional tier can be a more appropriate option. I recommend you head over to the pricing page to get a more comprehensive look into exactly what tools you get with each tier.

Restaurant365 also offers a useful online calculator where you can estimate the ROI of using its systems once you enter some key information.

You can also schedule a free demo to get a feel for its systems before making a final decision.

Get started with Restaurant365 here.

#5 – Payroll4free — Best Free Payroll Option

- For restaurants with up to 25 employees

- Pay both employees and contractors

- Automatic tax filing with upgrade

- Employee self-service portal

If you’re looking for a free payroll solution, you can use software like Payroll4Free. If you’re an established restaurant, this option isn’t for you, as you’ll likely be in need of more robust features. However, if you’re a small restaurant that’s running on a shoestring budget, then Payroll4Free can be worth a try.

Once you create an account, you’ll have access to features like the ability to pay both employees and contractors, vacation time tracking, employee portal for self-servicing, reporting features, direct deposit, and tax calculations. When you’re ready to file your taxes, Payroll4Free gives you access to filled-out tax forms you can review before turning them in. If you feel uncomfortable filing your own taxes, Payroll4Free can file them for you for a $15 monthly fee.

Keep in mind that Payroll4Free can only run on a Windows operating system. Moreover, Payroll4Free caps its services at 25 or fewer employees. Any more than that and you’ll have to onboard another payroll system.

Ready to take care of payroll for free? Get started with Payroll4Free here.

How to Find The Best Restaurant Payroll Software For You

Finding the best payroll option for you highly depends on the specific needs of your restaurant business. Unfortunately, a one-size-fits-all solution isn’t in the books here.

Besides the size of your business, your number of employees, and how much you plan on budgeting for payroll software, here are some additional pointers to think through to help you make the optimal choice.

Employee Self-Service

Payroll software with an employee self-service option can be a huge time saver. It makes the onboarding process easier since employees can log on and fill in their personal details and proper HR paperwork.

A payroll self-service feature also allows employees to sign in and check out their payroll history for their own reference. They can easily change their personal information in the self-service portal as well, without needing to file paperwork or schedule time-consuming meetings with HR.

Taxes

Most robust payroll software comes with plenty of features that can help you take care of your taxes easily and accurately. It’s good practice to ensure your payroll software can take care of both employee tax filing and 1099-MISC if you plan on working with contractors or have a seasonal business.

Some payroll software will even go as far as automatically filing your taxes for you. This is an extremely useful feature if your restaurant is in its early stages and can’t quite afford an in-house accountant. It can also be a way to avoid paying additional service fees for outside accounting services.

Payroll Support

Some payroll software providers are better at this than others. Generally, you’re better off going with payroll software that also comes with plenty of user support. This can come in the form of an easy-to-access knowledge base, free on-demand webinars, an online chat support feature, or a customer support team you can easily reach by phone.

While some payroll software will come with plenty of onboarding support, you want to make sure that support extends past the initial welcome process.

When in the middle of the chaos that running a restaurant can sometimes be, the last thing you want is a failing payroll system that’s malfunctioning without any access to timely help.

Summary

Calculating payroll can be a time-consuming process without the right tools in place. With payroll software, you can ensure you’re making fewer mistakes and that you’re paying your employees on time.

If you’re looking for an all-in-one payroll system that also has employee onboarding features, go with software like Toast. Don’t need payroll year-round for a seasonal restaurant? Square Payroll can help you get the job done. Gusto is a great option for restaurants that need everything automated.

Once you find a couple that feel good, I recommend you take advantage of any free trials and demos they offer. That way you can get a real feel for the software before making your final choice.

No comments:

Post a Comment